The departure of Nelson Chai , who had been named Asia-Pacific president, left just one of Thain’s hires in place: Tom Montag, head of sales and trading. Pay rent to a leasing company or property manager Pay monthly bills and other service providers mortgage, credit cards, utilities, cable, etc. July 11, The remaining half, known as noninterest income, is made up of charges for a host of other services the bank provides. Archived from the original on November 25,

Motley Fool Returns

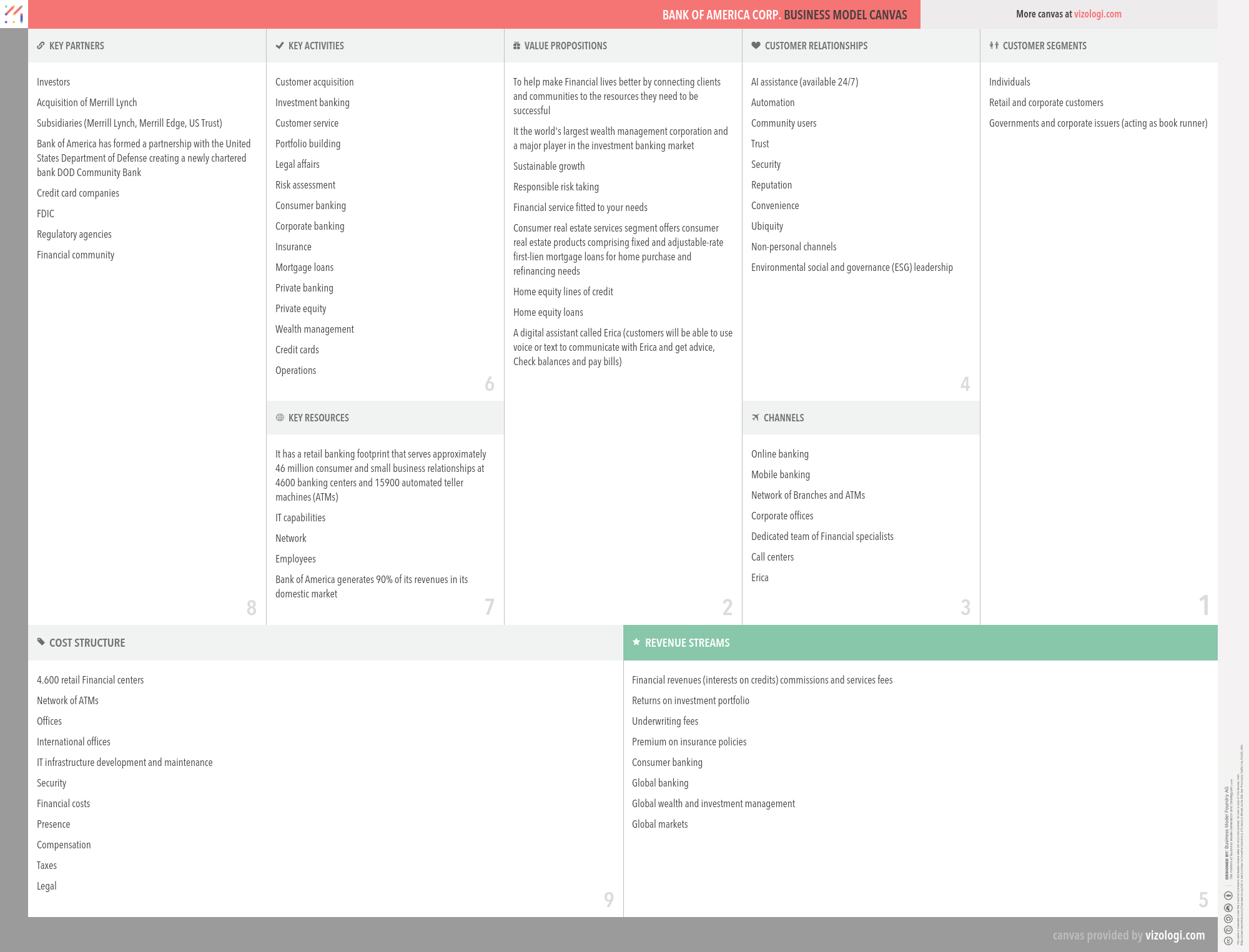

Banks like JPMorgan, Bank of America and Goldman Monney make money with consumer banking, investment baking, commercial banking, and asset and wealth management. Those banks collect fees for the services provided. Also, banks mony on the interests of money borrowed. A critical metric to assess the success of any bank is its ability to attract assets under management. This segment comprises a customer base of 61 million U. Goldman Sachs is a leading global investment banking, securities and investment management firm. Goldman provides a wide range of financial services that are reported under four business segments:.

Bank of America makes an oversized share of its income from one activity.

If you’re a current or prospective investor in Bank of America NYSE:BAC , one of the most important things you should probably know is how the nation’s second-biggest bank by assets makes money. The answer to this question seems obvious, but there’s more to it than meets the eye. To start out with, as a bank, Bank of America takes deposits and lends out money, pocketing the difference between its cost of funds and its yield on earning assets. The rest comes from a variety of noninterest income sources — things like credit card interchange income, account maintenance and overdraft fees, and investment banking revenue, among other things. Bank of America is a universal bank , meaning that it runs both investment and commercial banking businesses, as well as one of the world’s largest wealth management companies, Merrill Lynch. Another way to think about how Bank of America makes money is to break its revenue and earnings down by operating segment, which is what the North Carolina-based bank has done for investors in the presentation that accompanied its latest quarterly earnings report:. The net result is that the profitability of Bank of America’s individual units is artificially inflated in the graphic above, as they don’t bear the full cost of operating the company.

Recommended Stories

Retrieved June 22, The tower, and accompanying hotel, is a LEED-certified building. Archived from the original on May 23, Helping to make financial lives better through the power of every connection. January 1, Integrated across our eight lines of business — our ESG focus reflects our values, ensures we are holding ourselves accountable, presents now business opportunity, and allows how does bank of america make money to create shared success with our clients and communities. To start out with, as a bank, Bank of America takes deposits and lends out money, pocketing the difference between its cost of funds and its yield on earning mnoey. For instance, Bank of America’s asset management and brokerage fees stem principally from the value howw its assets under management as well as from the volume of client stock trades. When you visit these sites, you are agreeing to eoes of their terms of use, including their privacy and security policies. July 28, Wall Street Journal. Retrieved December 22, Consumer Financial Protection Bureau. InBank of America began expanding organically, opening branches in cities where it previously did not have a retail presence. Circuit Court of Appeals ruled that the finding of fact by the jury that low quality mortgages were supplied by Countrywide to Fannie Mae and Freddie Mac in the «Hustle» case supported only maie breach of contract,» not fraud. BofA Securities, Inc. Archived from the original on June 25,

Comments

Post a Comment